In our current reality where burglary is tragically pervasive, having protection inclusion for your resources is principal. Whether it's your home, vehicle, or business property, burglary protection can give a security net in case of deficit or harm because of robbery. Notwithstanding, documenting an effective burglary insurance guarantee requires something other than having a contract set up. It requests an essential methodology, scrupulousness, and a comprehension of the cases cycle. In this article, we'll dig into master counsel on the best way to explore the intricacies of recording a fruitful theft insurance claim.

Navigating the Claims Process with Confidence and Precision

Understand Your Policy

The most vital phase in documenting a fruitful theft insurance claim is to completely comprehend your protection contract. Audit your strategy reports cautiously to get a handle on the degree of inclusion accommodated robbery related episodes. Focus on any restrictions, avoidances, deductibles, and exceptional circumstances that might apply. Being educated about your arrangement terms will assist you with exploring the cases interaction all the more actually.

Act Promptly

There isn't a moment to spare with regards to documenting a theft insurance claim. Most insurance contracts have explicit cutoff times for revealing burglary episodes and documenting claims. Inability to stick to these courses of events could bring about your case being denied. When you find the burglary or harm, advise your insurance agency immediately to start the cases cycle.

Document the Incident

Exhaustive documentation is essential for validating your theft insurance claim. Take nitty gritty notes of the conditions encompassing the robbery, including the date, time, and area of the occurrence. If material, document a police report and get a duplicate for your records. Archive any proof of constrained passage, harm to property, or missing things. Moreover, photos or recordings can act as significant proof to help your case.

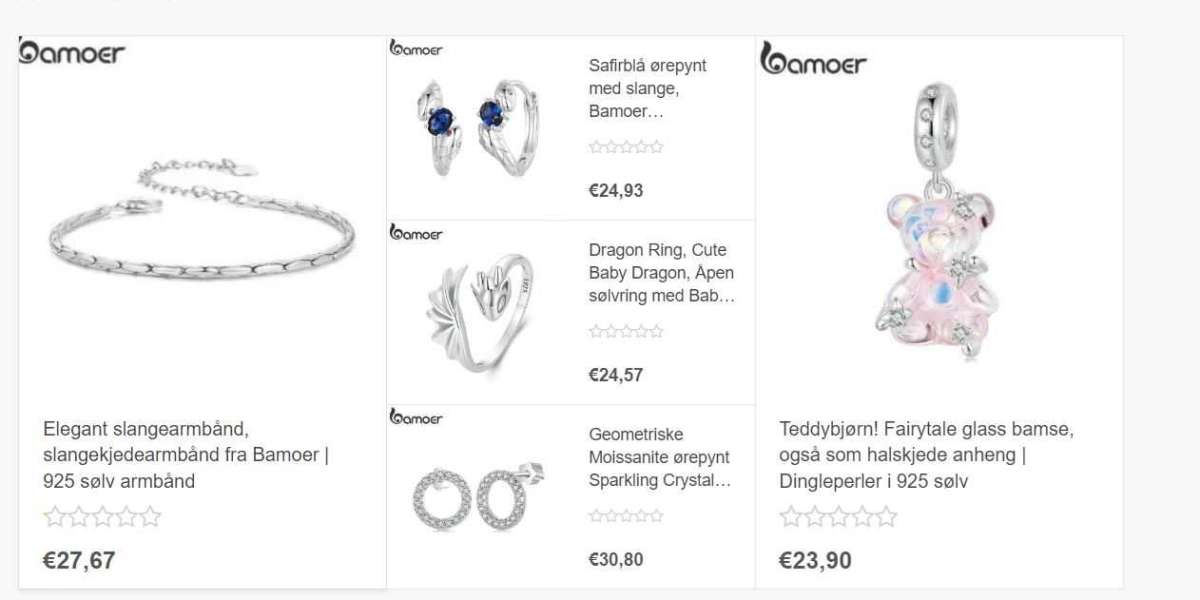

Provide Proof of Ownership

While documenting a theft insurance claim, you'll have to give proof of possession to the taken things. This might incorporate buy receipts, solicitations, chronic numbers, evaluations, or photos of the things in your control. Keeping a stock of your effects with significant documentation can smooth out the cases interaction and work with a smoother goal.

Cooperate with the Investigation

Insurance agency commonly leads examinations to survey the legitimacy of theft claims. Participate completely with the backup plan's examination cycle, giving any mentioned data or documentation instantly. Tell the truth and approaching in your correspondence with the protection agent, as any disparities or irregularities could risk your case.

Mitigate Further Losses

Go to proactive lengths to relieve further misfortunes or harm following a burglary episode. Secure your property to forestall extra burglary or defacement. For instance, in the event that your home has been burglarized, consider introducing safety efforts like locks, cautions, or observation cameras. By finding a way sensible ways to relieve further misfortunes, you exhibit persistence and obligation, which can reinforce your protection guarantee.

Keep Records of Expenses

All through the cases interaction, keep nitty gritty records of any costs caused because of the burglary. This might incorporate impermanent housing costs, fix costs, substitution buys, or other related uses. These archived costs can be remembered for your protection guarantee for repayment, if they are sensible and vital.

Review Your Settlement Offer

When the insurance agency has evaluated your case, they will give a settlement offer illustrating the pay they will give. Cautiously audit the settlement deal to guarantee it precisely mirrors the degree of your misfortunes and is as per your arrangement inclusion. Assuming you have any worries or disparities, go ahead and explanation from your protection agent.

Consider Professional Assistance

In cases including mind boggling or questioned theft insurance claim, looking for proficient help from a public agent or lawful guidance might be prudent. These specialists spend significant time in supporting for policyholders and can assist with exploring the cases cycle, haggle with the insurance agency, and expand your case settlement. While proficient help might include extra expenses, it tends to be important in getting a fair result.

Appeal if Necessary

Assuming your theft insurance claim is denied or you are disappointed with the settlement offer, you reserve the privilege to pursue the choice. Survey the explanations behind disavowal given by the guarantor and assemble any extra proof or documentation to help your case. Follow the allure techniques illustrated in your insurance contract, and think about looking for direction from an expert supporter if necessary.

Conclusion

Recording a fruitful theft insurance claim requires cautious readiness, documentation, and adherence to the cases interaction. By figuring out your strategy inclusion, acting instantly, giving thorough documentation, and helping out the back up plan's examination, you can improve the probability of a good result. Moreover, taking into account proficient help and engaging a refusal in the event that essential can assist with shielding your freedoms and interests as a policyholder. Keep in mind, with regards to burglary protection cases, information and readiness are your best partners in getting enough pay.